No More Government Subsidy for Conducting Business on the Golf Course!

(Meals and Entertainment Deduction Limitation)

Many business deals are made on the golf course or in the sky box of sports games. However, starting in 2018, no tax deduction is allowed for the expenses incurred in connection with these types of activities.

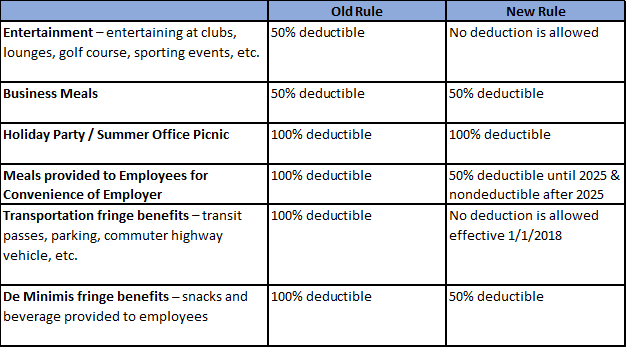

Prior to the Tax Cuts and Jobs Act (the “Act”), taxpayers generally could deduct 50% of meals and entertainment expenses incurred or paid for active conduct of trade or business. Additionally, meals provided to an employee for the convenience of the employer on the employer’s business premises were 100% deductible. However, the Act has substantially limited the deductibility of certain meals and entertainment expenses effective January 1, 2018, and the following chart summarizes the new rule.

Takeaway

The Act significantly limits taxpayers’ ability to deduct expenses incurred in connection with business meals and entertainment, as well as certain fringe benefit. Taxpayer should consider tax cost of these types of activities. Additionally, to maximize tax deductions, set up and track separate general ledger accounts for business meals, entertainment, recreational events, and fringe benefits.