Financial Statement Impact of PPP Loan

The Paycheck Protection Program (“PPP”) was established as part of the Coronavirus Aid, Relief and Economic Security Act (“CARES Act”) and it provides loans to qualifying businesses for amounts up to 2.5 times of the average monthly payroll expenses. The loans and accrued interest may be partially or fully forgivable, if the borrower uses the proceeds for qualifying expenses such as payroll, employee benefits, mortgages interest, rent, and utilities. The amount of loan forgiveness may be reduced if the borrower terminates employees or reduces salaries during the covered period. The unforgiven portion of the PPP loan is payable over two years with an option of extension to five years at an interest rate of 1%, with a deferral period of up to ten months.

AICPA issued Technical Question and Answer (TQA) 3200.18 (the “TQC”) in accordance with US GAAP which addresses non-governmental accounting for forgivable loans received under the PPP. According to the TQA, non-governmental entities may account for PPP loans under FASB ASC Topic, 470, Debt, or as a government grant under FASB ASC Topic 958-605, Not-for-Profit Entities, when certain circumstances are met.

The entities, that are not governmental nor nonprofit, can treat the PPP loan as either 1) debt or 2) government grants.

- Loan (ASC Topic 470-50) – if an enterprise elects to treat the PPP loan as a debt, it can be derecognized only upon formal forgiveness of the debt by the lender (SBA) or repayment of the debt. The amount of loan forgiveness received can then be recorded as gain on extinguishment of debt.

- Grant (ASC Topic 958-605) – if an enterprise expects to meet the forgiveness eligibility requirements and concludes that it can be forgiven, in substance, then PPP loan can be treated as grant.

Additionally, subsequent to the passage of the CARES Act, the IRS clarified in Notice 2020-32 that (i) no deduction is allowed under the Internal Revenue Code for an expense that is otherwise deductible if the payment of the expense results in forgiveness of the PPP loan, and that (ii) the income associated with the forgiveness is excluded from gross income for purposes of the Code pursuant to section 1106(i) of the CARES Act. This precludes to deduct business expenses funded with PPP loan proceeds that are ultimately forgiven, thereby preventing taxpayer from claiming a double tax benefit on the qualifying expenses for PPP loans.

Therefore, while forgiveness loan amount is excluded from gross income, the PPP loan amounts used for qualifying expenses are nondeductible for federal tax purposes. Nontaxable forgiveness loan amount and the nondeductible qualifying expenses are permanent differences which are not subject to the tax provision. If borrower have nontaxable forgiveness loan amount and nondeductible expenses in the same period for tax purposes, there is no impact on the tax provision. However, if borrower uses the proceeds for qualifying expenses which are not deductible in 2020 and receive forgiveness which are excludable from income in 2021, then unfavorable tax treatment will have occurred in 2020.

The following examples illustrate the varying financial reporting and tax consequences of the Notice 2020-32:

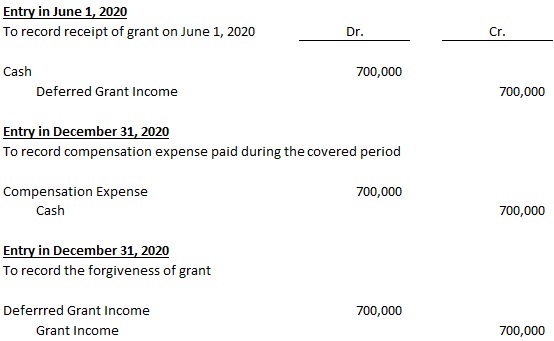

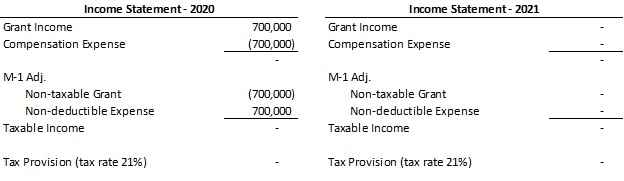

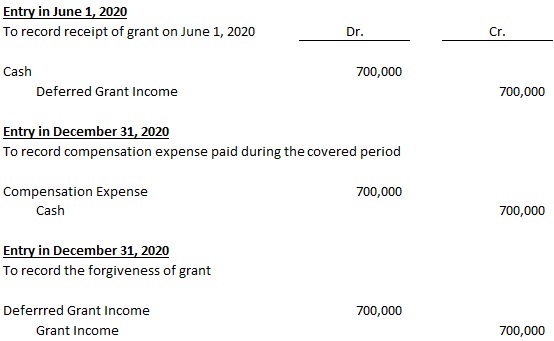

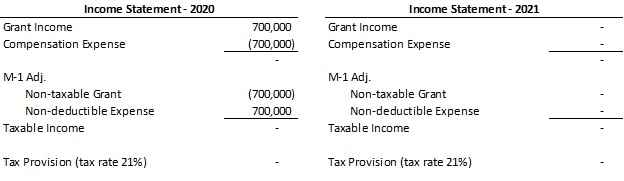

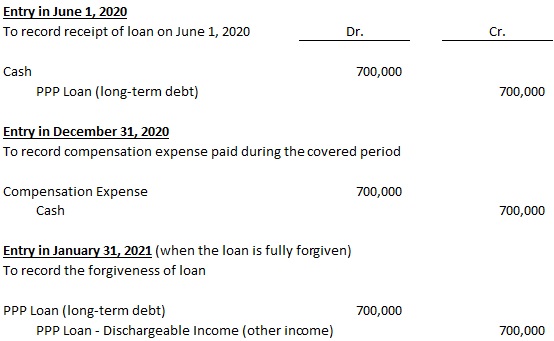

Example 1: 100% Certain about Full Forgiveness of PPP Loan

Assume that Company X received PPP loan $700,000 on June 1, 2020. As of December 31, 2020, the Company X expects to meet all the forgiveness eligibility requirements and concludes that the full forgiveness of $700,000 is probable. In this case, Company X can elect to treat the PPP loan as grant, recognizing the gain on the income statement.

Following is the presentation on the financial statements and tax provision:

The non-deductible compensation expense and non-taxable grant income occurs in the same tax year. Thus, no tax impact.

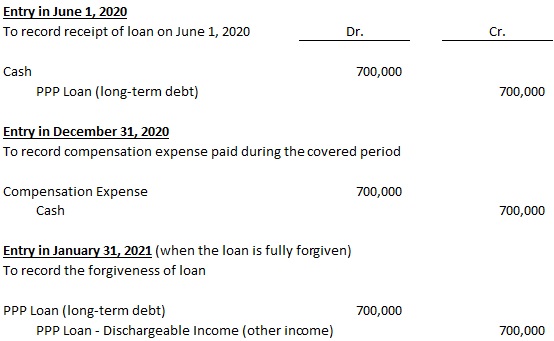

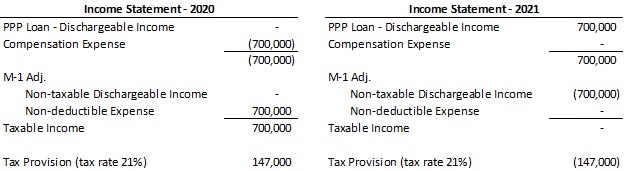

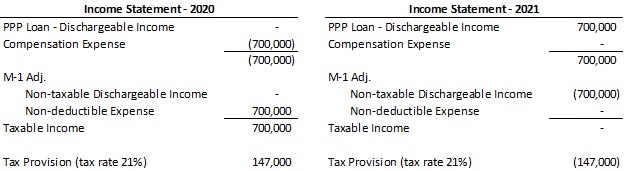

Example 2: Uncertain about Full or Partial Forgiveness of PPP Loan

Assume that Company X received PPP loan $700,000 on June 1, 2020. As of December 31, 2020, the Company X is uncertain whether it will meet the forgiveness eligibility requirements. In this case, Company X must treat the PPP loan as a loan. Since the loan can only be written off from its balance sheet (i) when the loan is paid or (ii) when the entity is legally released from the liability, the Company X’s 2020 balance sheet would include a loan of $700,000.

Following is the presentation on the financial statements and tax provision:

The non-deductible compensation expense and PPP loan – dischargeable income occurs in the different tax year. Therefore, timing difference of tax effect occurs.

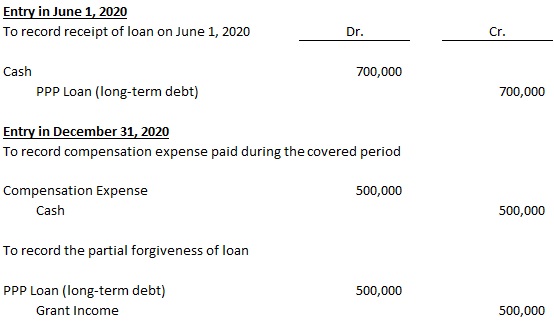

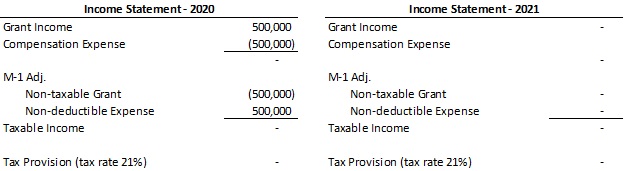

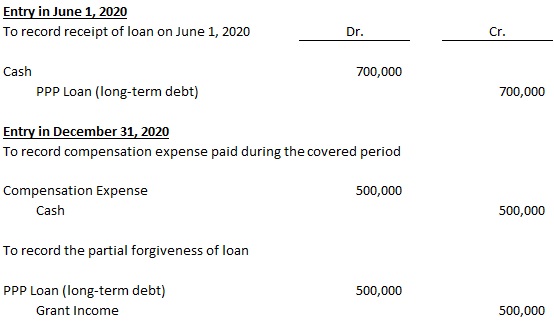

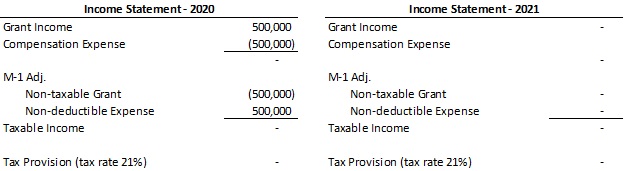

Example 3: Expect Partial Forgiveness of PPP Loan

Assume that Company X received PPP loan $700,000 on June 1, 2020. As of December 31, 2020, the Company X meets the partial forgiveness eligibility requirements and expect to receive partial forgiveness of $500,000. In this case, Company X may record as gain on the portion of a PPP loan that expect to be forgiven and the remainder as a loan.

Following is the presentation on the financial statements and tax provision:

The non-deductible compensation expense and grant income occurs in the same tax year. Thus, no tax impact on forgivable portion of loan $500,000. Unforgivable portion of loan will be remaining as a loan on Company X’s balance sheet.

As shown in above, depending on how the PPP loans is treated as either debt or grants, taxpayer may have some different impact on income tax provision. Thus, each entity is required to carefully review the circumstances and related regulations when determining proper accounting and tax treatment. Please consult with your service provider.