GILTI & BEAT in Plain Language

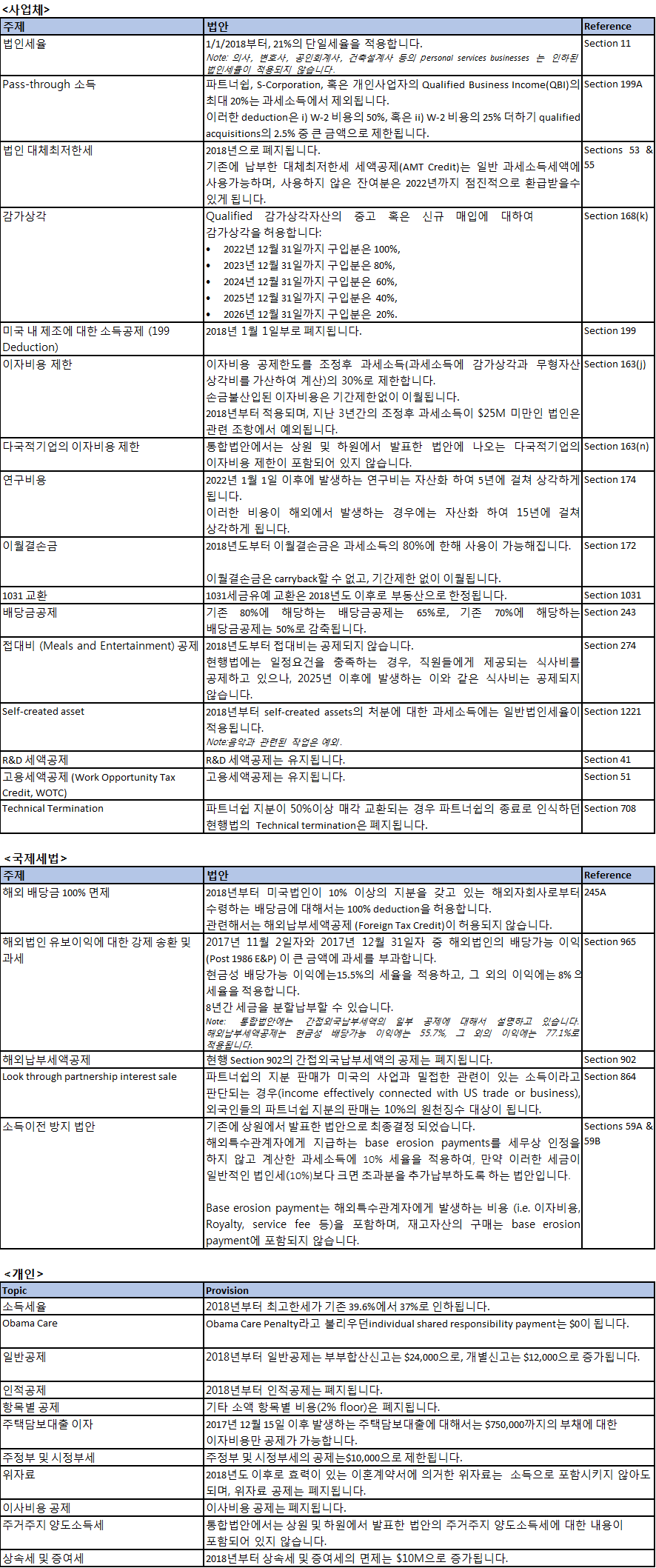

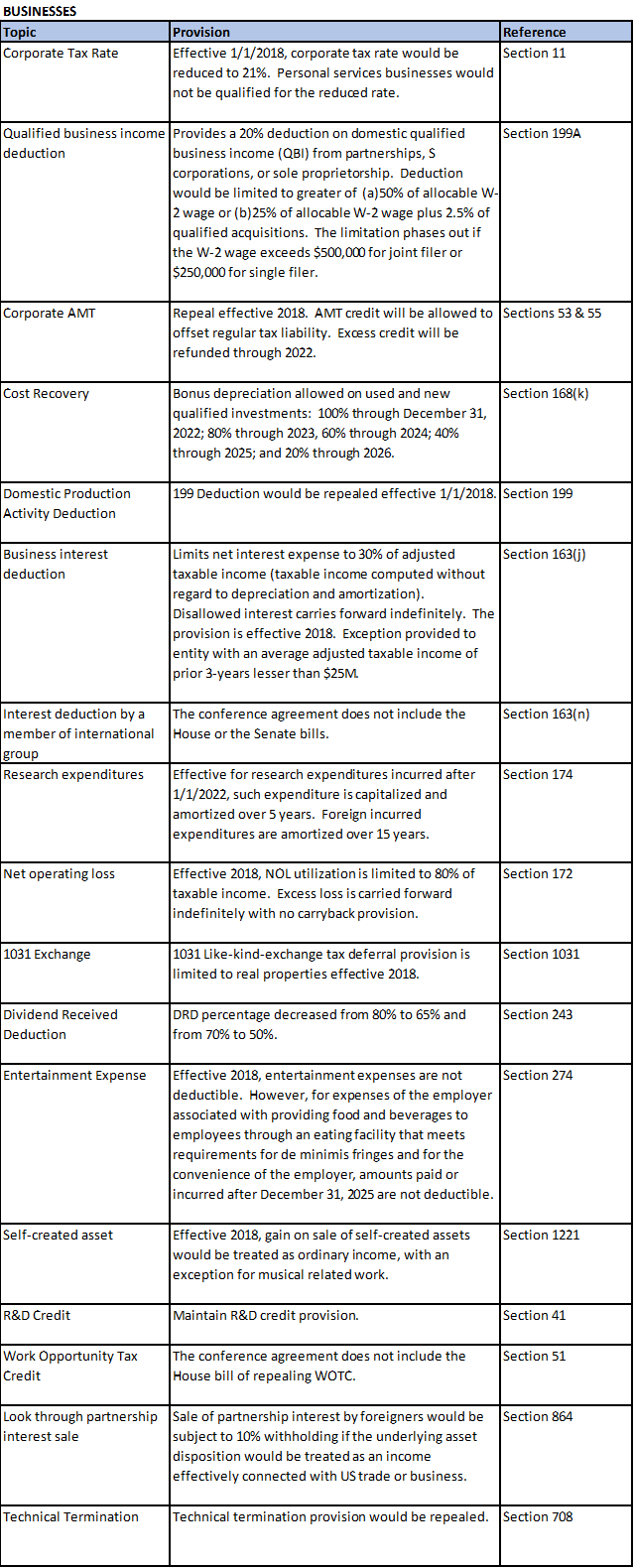

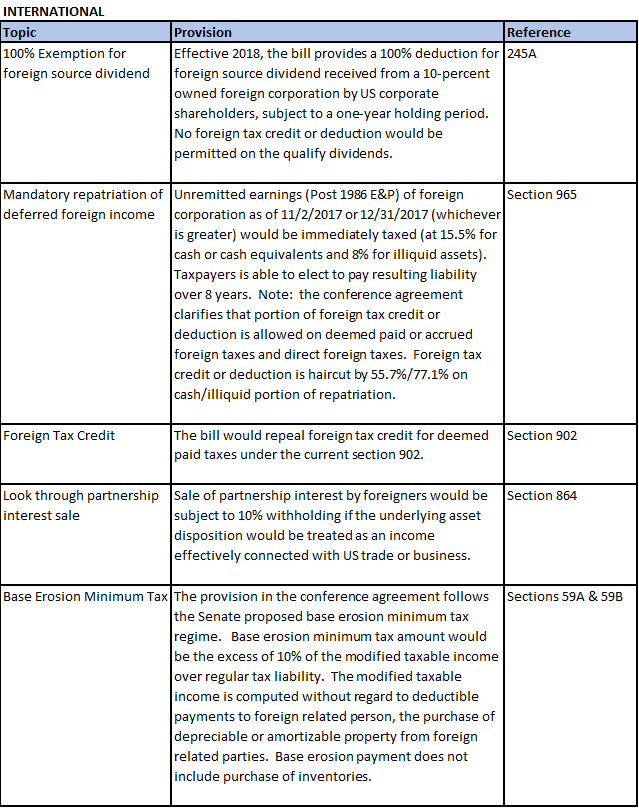

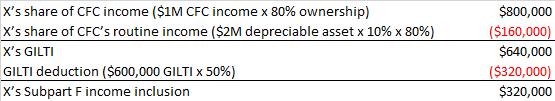

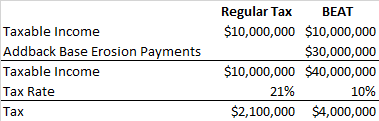

There are two provisions contained in the Tax Cuts and Jobs Act which may have unwary impact to multinational businesses effective for a tax year starting after December 31, 2017. These two provisions were given fancy names and the rules are extremely complex. One is Global Intangible Low Taxed Income (“GILTI”), enacted to keep the earnings deemed associated with U.S. intangibles within the United States. The other one is Base Erosion and Anti-Abuse Tax (“BEAT”), designed to minimize tax revenue loss resulting from payments to foreign related parties by their affiliated U.S. companies.

We will try to explain these two overly complex tax rules in a plain language so that even those with little or no tax background may understand how the rules work and may impact their associated business.

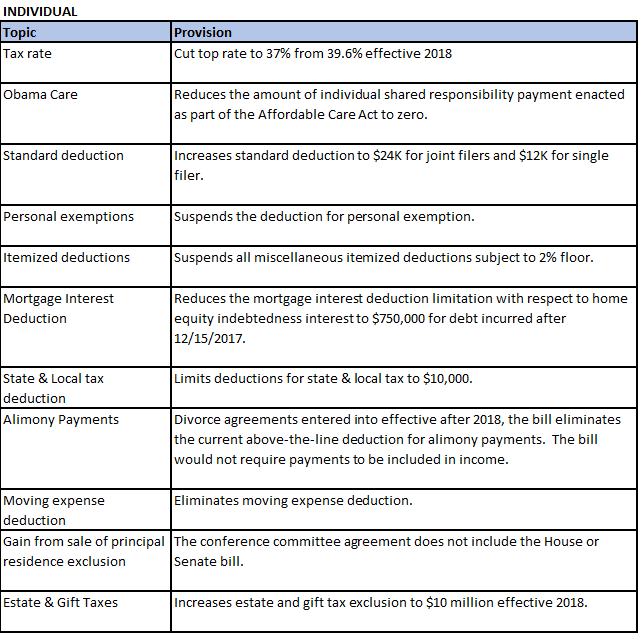

Global Intangible Low Taxed Income

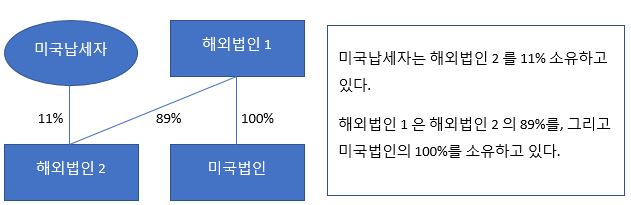

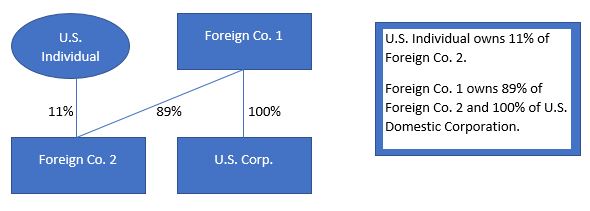

GILTI applies to U.S. shareholders of a controlled foreign corporations (“CFC”). Its intention is to include CFC’s income in excess of its ‘routine income’ in the U.S. shareholders’ taxable income. In a nutshell, every year, U.S. shareholders of CFCs are required to test if the CFC generated income in excess of its routine income and the excess income are included in the U.S. shareholders’ taxable income. The routine income is artificially set at 10% of CFC’s investment in depreciable assets – tangible assets. Income in excess of the routine income is considered as earnings attributable to U.S. intangibles. In computing taxable income, U.S. shareholders are allowed deduction equal to 50% of GILTI for the tax years from 2018 through 2025 and 35% of GILTI from taxable years after 2025.

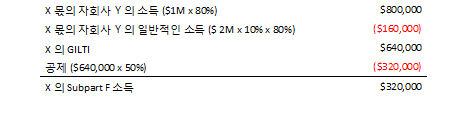

Illustration:

X is a U.S. taxpayer who owns 80% of a foreign company, Y. During the calendar year 2018, Y generated $1,000,000 of income. Y has an average balance of depreciable assets in the amount of $2,000,000 for the year. X is required to include $300,000 of income in his/her tax return for the year.

Takeaway is U.S. shareholders of a CFC with high income relative to its investment in hard assets should consult with their tax consultants to assess the potential impact of GILTI tax provision contained in the Tax Cuts and Jobs Act.

Takeaway is U.S. shareholders of a CFC with high income relative to its investment in hard assets should consult with their tax consultants to assess the potential impact of GILTI tax provision contained in the Tax Cuts and Jobs Act.

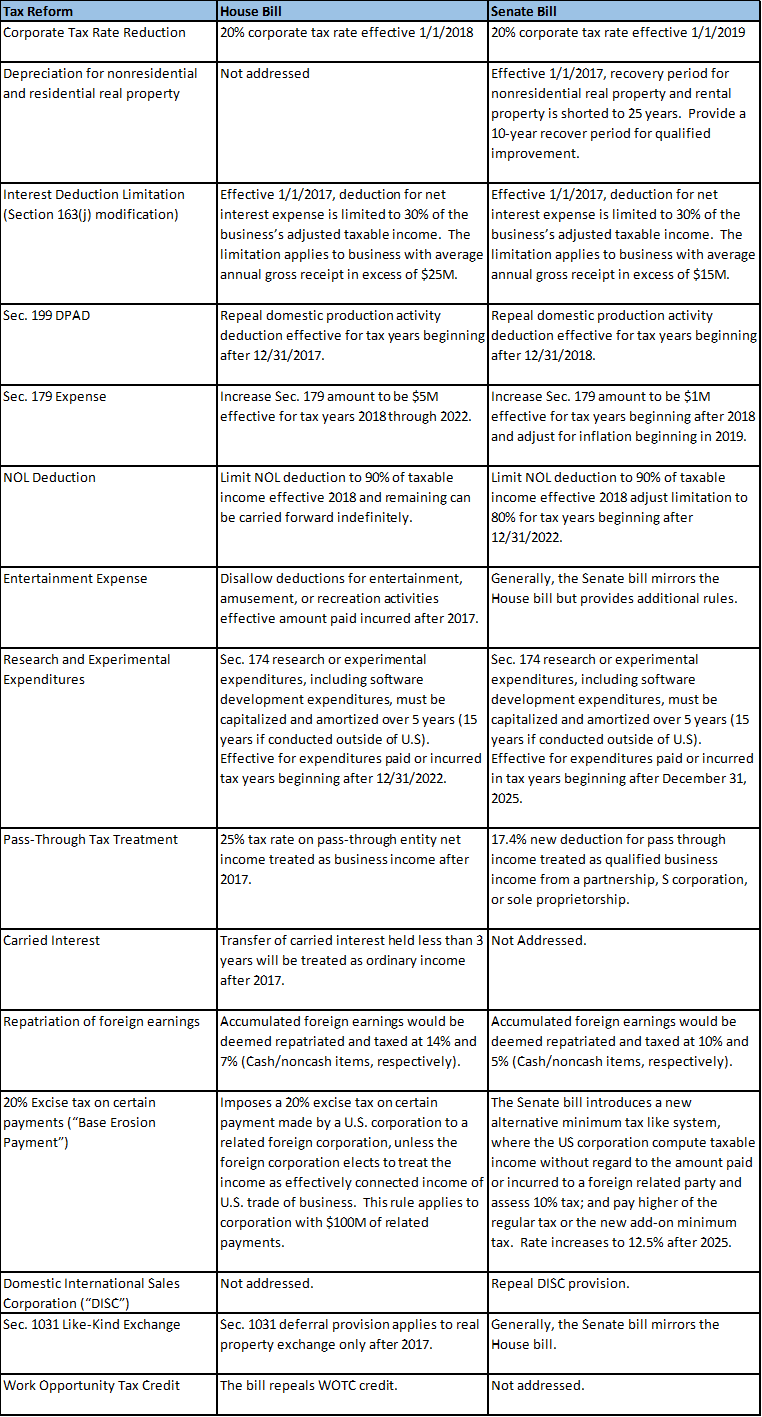

Base Erosion & Anti-Abuse Tax

BEAT applies to U.S. companies with relatively large outbound payments (paid or incurred) to its foreign related parties. Generally, any outbound payments resulting in U.S. tax deductions, depreciation and amortization (with exceptions for inventory purchase and service cost reimbursements) are considered as base erosion payments and they are disregarded in computing an alternative taxable income (referred as “modified taxable income”).

U.S. companies are required to compute the modified taxable income and compute alternative tax at 10% (5% for the tax year 2018). U.S. companies’ tax liability for a tax year is higher of the regular tax or the alternative tax computed without base erosion payments.

BEAT provision applies to affiliated group with U.S. source gross income in excess of $500 million and base erosion payments account for 3% or more of the total U.S. deductions.

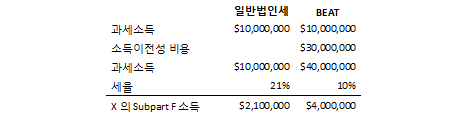

Illustration:

X, a U.S. corporation, has $10,000,000 taxable income for 2019 tax year, which includes $25,000,000 royalty payment to its foreign parent company and $5,000,000 depreciation deduction on machineries acquired from its foreign related party. (For purpose of the illustrations, we will assume that there is no withholding tax). X is subject to BEAT minimum tax of $1,900,000, in addition to the regular tax of $2,100,000.

Takeaway is U.S. companies with considerably large base erosion payments to foreign related parties should consult with their tax consultants to assess the potential impact of BEAT provision contained in the Tax Cuts and Jobs Act.

THE INFORMATION CONTAINED HEREIN IS OF A GENERAL NATURE AND BASED ON AUTHORITIES THAT ARE SUBJECT TO CHANGE AND DIFFERING INTERPRETATION. APPLICABILITY OF THE INFORMATION TO SPECIFIC SITUATIONS SHOULD BE DETERMINED THROUGH CONSULTATION WITH YOUR TAX ADVISER. ANY TAX ADVICE IN THIS COMMUNICATION IS NOT INTENDED TO BE USED AND CANNOT BE USED, BY A CLIENT OR ANY OTHER PERSON OR ENTITY FOR THE PURPOSE OF (i) AVOIDING PENALTIES THAT MAY BE IMPOSED ON ANY TAXPAYER OR (ii) PROMOTING, MARKETING OR RECOMMENDING TO ANOTHER PARTY ANY MATTERS ADDRESSED HEREIN.